Let's fix the leaks in your bucket and stop overpaying the Banks and Taxes!!!

First things first, stop giving away your hard earned money!!

Just two of our Tools in our Arsenal to save you money!!

Click the one most beneficial to you!

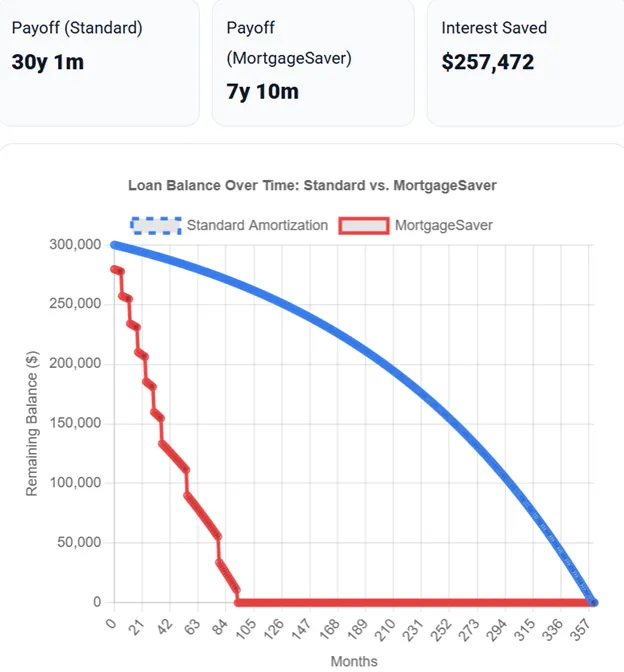

Mortgage Saver

How much can you be saving?

Tax Strategies that you will FIRE your Accountant for not telling you about them for all these years!!!

Don't take my word, take the test!

In less than 5 min you will discover how much you should be saving in taxes and how Real Estate Investing is the BEST tax strategy!!

Testimonials

Dave Diehl, Investor

At first I didn’t know where to start. These gave me the direction I needed — it helped me understand and how to manage deals the smart way.

Daniel Arellano,

Entrepreneur

"It’s a financial GPS. It showed me where my money was going, how to use it strategically, and how to scale safely. I’m now investing at a level I never thought possible, and it all started with this tool.”

Duane Stone,

Investor

"These gave me confidence and it gave me purpose. I’ve not only learned how to create financial freedom but also how to design a lifestyle of balance, growth, and impact. This is about reclaiming control of your life.”

FAQs

Answers to Your Top Real Estate Investment Queries

What sets REI Deal Network apart from other real estate consultants?

REI Deal Network uniquely combines market expertise with a vast industry network to tailor strategies for each client.

Can REI Deal Network help me if Im new to real estate investing?

Absolutely! We cater to both novice and experienced investors with educational resources and personalized consulting.

How do I know which investment strategy is best for me

During our initial consultation, we assess your financial situation, investment goals, and risk tolerance. Based on this assessment, we recommend strategies that best fit your profile and objectives.

What geographic areas does REI Deal Network cover?

We focus on real estate markets in the United States, especially in urban and emerging suburban areas.

Does REI Deal Network offer any technology for investment tracking?

Yes, we provide proprietary platforms for real-time investment performance and market trend analysis.

How do REI Deal Networks services compare cost-wise with others in the market

We offer competitive pricing structured around value-added services ensuring quality tailored to investment scales and needs